For years, expert advice to move into assets displaying a high degree of climate change resilience went unheeded by an investment industry afflicted with inertia. Now, in reaction to shifting political winds and ever more manifestations of extreme weather events the investment industry is undergoing profound change. As policy makers prepare to forge robust and incisive climate change regulations on a global level and considering the hundreds of trillions of value at stake due to climate risks, the topic of assessing the climate change resilience of companies has undoubtedly arrived as a crucial investment issue – a trend unlikely to unwind for decades to come.

Against this background PIK and the award-winning Swiss fintech startup Carbon Delta work together in the Climate-KIC funded Demonstrator project CRAMs to develop a global assessment of the economic impacts of climate change on corporate activities. That means, by applying and improving existing climate data sets, damage, growth and cost functions, as well as CO2 pricing models the project translates major climate policy and physical climate impact risks into comprehensive financial risk assessments. In order to get a broad overview of the global financial sector, the project is accompanied by an advisory board, which is representative of pension fund managers, insurance companies, private banks and sustainable asset managers investing globally.

The overall goal of the project is to refine and thus optimize Carbon Delta's Climate Value-at-Risk (Climate VaR) model – an innovative assessment method tailored specifically towards the needs of investors in managing climate change risks within investment portfolios.

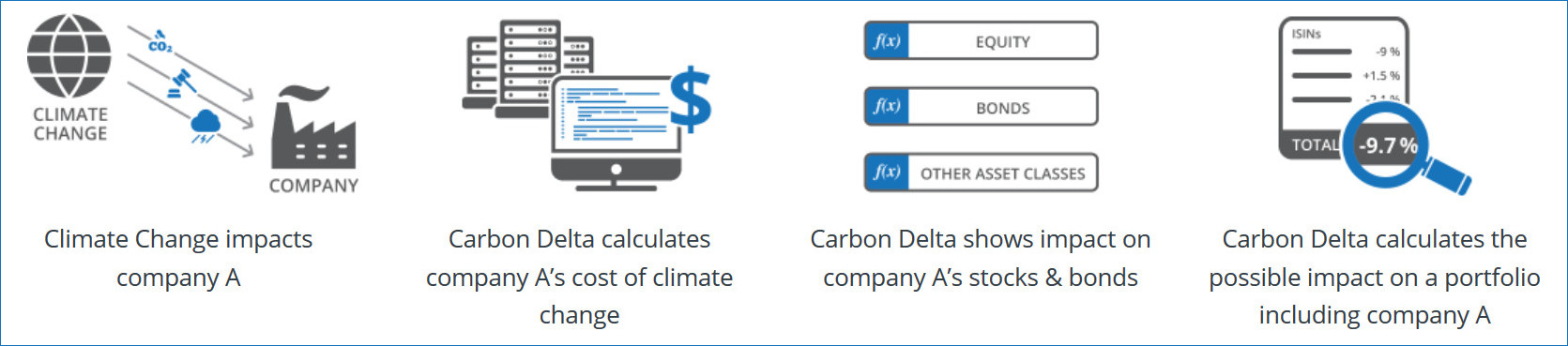

Carbon Delta’s Modeling Philosophy (© Carbon Delta)

The impact of integrating the Climate VaR into investment decision making is straightforward: climate change risk can be managed. By recommending to diversify, divest or engage, the Climate VaR either creates value by redirecting investments to more profitable assets or it prevents losses by helping investors to steer clear of vulnerable investment outlets. But the impact of the Climate VaR goes far beyond the immediate financial gains of investors. Further down the line, by inducing capital to flow towards climate change-resilient assets, it helps to promote the use of renewable energies and climate-friendly technologies as well as the development of climate-friendly business models – and thus accelerates the transition to a future zero-carbon economy.

For further information, please click here.

Contact:

Dr. Thomas Nocke

Phone: +49 331 288 2626

E-Mail: nocke@pik-potsdam.de

CRAMs is funded by the EIT Climate-KIC.