12/15/2021 - CO2 emissions trading – a key element of EU climate policy – can be protected from distortions driven by financial speculators, a new report shows. The price for CO2 emissions allowances in the EU cap-and-trade scheme has almost tripled in the course of this year, and is now subject to unprecedented volatility levels. Financial speculation is increasingly blamed for this price rally, but evidence is lacking whether this can actually endanger the functioning of the trading system for the most relevant greenhouse gas. The researchers propose tools to detect speculation, evidence a substantial risk from a new breed of investors, and suggest improvements for market oversight.

“While some stakeholders exaggerate the risk of speculation, not least of the political ramifications of high CO2 prices, others downplay them, which often is also politically or financially motivated,” says Michael Pahle, co-author of the breaking report written with Simon Quemin, and an economist at the Potsdam Institute for Climate Impact Research. The current heated debate has already culminated in a call by Spain and Poland to investigate speculation by the European Securities and Markets Authority (ESMA).

The number of new financial actors active in the EU ETS tripled in the past three years

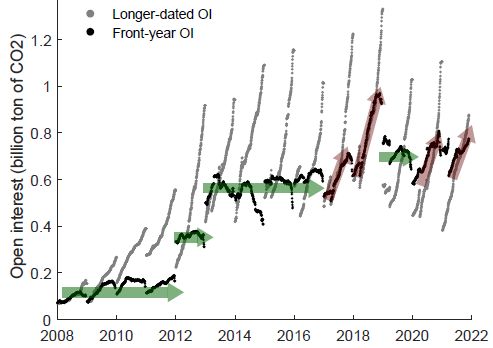

For their own investigation the researchers draw on a relatively new and rarely used data source mandated under the EU financial market regulation. It monitors the so-called futures contracts, which are the financial product of choice for speculation because trading is fast and frequent, and not directly supervised by Emission Trading System regulators. This data shows that the number of new financial actors, mainly investment funds, more than tripled in the past three years. However, what is unclear is to which degree increased trading by financials impacts normal price formation.

To answer this question, the researchers developed a method to map financial players’ behavior in the carbon market according to their trading motives, and classify their activity into two types of market functions: beneficial ones, notably hedging that allows regulated firms to offload the risk of uncertain future carbon prices; and detrimental ones that may lead to excess volatility, price bubbles and potentially a stockpiling of allowances by large investment funds to influence prices. These risks are bound to increase over time because by design allowances in the market will become scarcer.

Regulators should enhance data quality, diagnostics, and create a specific market oversight authority

“To prepare for this risk, financial and allowance market regulators need to do three things. First, they must enhance transparency with better data availability and more timely disclosure. Second, they can enhance their diagnostics, using tools like those we’re proposing but also econometric methods. Third, they should create a specific market oversight authority,” says Simon Quemin. “Analyzing speculation in other commodity markets can serve as a benchmark with which to contrast emissions allowance markets. This way, the new authority could take evidence-based action, and curb speculation if warranted.”

Action in this direction is of utmost importance because a wait-and-see approach can have profound implications for regulated industries and consumers. “If we let speculation run wild, this can sooner or later undermine the functioning of CO2 emissions allowance markets,” says Michael Pahle. “So putting in place better monitoring and integrated regulation now can prevent fundamental problems later on. This can protect the EU Emission Trading System from excessive financial speculation, and thus pave the way for more stringent and robust carbon pricing – also in other emission trading systems worldwide like in the US and China."

Working paper

Simon Quenin, Michael Pahle (2021): Financials threaten to undermine the functioning of emissions allowance markets. Social Science Research Network [DOI:10.2139/ssrn.3985079]

Link to the paper:

Contact:

PIK press office

Phone: +49 331 288 25 07

E-Mail: press@pik-potsdam.de

Twitter: PIK_Climate

www.pik-potsdam.de