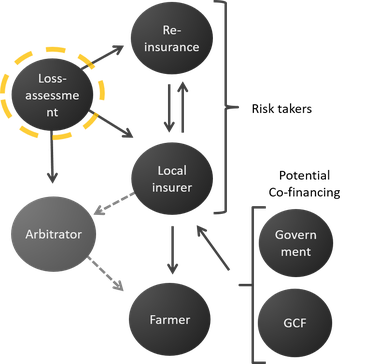

Millions of smallholder farmers across the world severely suffer from crop losses due to increasingly variable and extreme weather patterns. For instance in India, shifting onset and withdrawal of the seasonal monsoon and droughts such as the one experienced in 2015 left millions of farmers at loss. Similarly, in 2015/2016 El Niño events brought devastating droughts to East Africa rendering 24 million people food insecure. While risk management plays a significant role in building resilience for agricultural producers, not all risks can be mitigated through implementing adaptation measures. For remaining risks, innovative risk transfer mechanisms are needed. The IPCC AR5, G20 leaders and the last climate conferences (COP21–24) have addressed insurances as holding a large potential to fill this gap. Well-functioning insurance schemes would mean that farmers are reimbursed for their losses allowing them to reach income stability and invest in relevant farm management measures, thereby increasing resilience to climate shocks. However, as it stands, the widespread implementation of insurance schemes is hindered by uncertain and unreliable assessments of crop yield losses. If weather-attributable yield losses were assessed more accurately, this information could make insurance schemes more operative to insurers, less costly for governments and more accessible to smallholder farmers.

The burning problem for smallholder crop insurances in most developing countries is the lack of tools to accurately assess weather-attributable yield losses in a remote way. Where solutions exist, such as in India or Kenya, assessment through field visits (crop cuts) in absence of better remote assessment methods makes agricultural insurance extremely costly.

Using the example of East Africa, one can identify three central challenges that contribute to the state of poor assessment:

- Farm holdings are particularly small, amounting to a regional average of 1.6 ha per holding (stance 2013). Comparatively, the German average area per holding is 55.8ha (stance 2010) and 234ha in the US Corn Belt [1]. As a result, accurately depicting the on-ground farm reality from a distance requires scientific innovation

- The farming population is particularly large and remote in East Africa, with an average of 75% of the labor force in the region employed in agriculture. The vast quantity of farm holdings in East Africa implies the impracticality of single farm visits by a claim adjuster for the purpose of crop loss determination.

- Historical crop yield as well as weather data are scarce, difficult to access and mostly need correction. This makes a comparative assessment of yields across time additionally challenging.

We are introducing a remote and accurate loss assessment method that aims at addressing the challenges outlined above. Our analysis is based on the continuous development and implementation of the AMPLIFY model (AMPLIFY: Agricultural Model for Production Loss Identification to Insure Failures of Yields). The novelty of AMPLIFY is its ability to combine several sources of data as well as various models. The tool makes use of statistical as well as process based models using historical weather and yield data as well as remote sensing information to remotely assess crop yields and yield losses. It thereby allows to crucially differentiate between climate-related and non-weather-related (agronomic management, socio-economic) yield loss perils. By combining re-analysed weather and remote sensing data, AMPLIFY assesses yield losses on a field and district level.

Because agricultural insurances are only interested in insuring the weather-related components that lead to crop losses, AMPLIFY uses weather-related factors alone for the insurance index calculation. This helps insurance companies to determine their payouts (claim costs) based on actual crop yield losses. Improving the loss assessment of crop insurances, transaction costs currently spent on individual farm visits can be reduced. This would increase affordability and outreach of insurances to smallholder farmers. This dual achievement enables the disbursement of claims to more farmers in the event of weather related crop losses, which contributes to the income stability of a farming household. Ultimately, this can build resilience and enhance the farmers’ ability to adapt to changing climate conditions, positively impacting the farmers’ livelihoods.